Awards, Gifts, and Prizes Policy

Awards, Gifts, and Prizes Policy

Purpose

The University of Dayton supports the recognition of its community members and others for their contributions through the use of awards, gifts and prizes. However, payments made or other items of value given may be considered taxable compensation unless a specific exemption applies. This policy sets forth the University’s requirements and expectations for the use of University funds for awards, gifts, and prizes and provides guidance regarding the tax consequences in order to remain in compliance with the Internal Revenue Service (IRS) and other legal requirements.

Scope

This policy applies to all University of Dayton Faculty, Staff and Students when University funds are used. This policy does not apply to awards, gifts, or prizes paid personally by individuals without reimbursement or donation receipt by the University.

Policy History

Effective Date: March 23, 2016

Approval: March 23, 2016

Policy History:

- Approved in Original Form: March 23, 2016

Maintenance of Policy: Vice President for Finance and Administrative Services

Definitions

(a) “Awards” are items given for meritorious performance, productivity, or other reason connected with employment; for nonemployees, given in recognition of an accomplishment, achievement or activity that does not require the performance of a service as well as for other valid business reasons. Examples include achievement in teaching, research, retirement or other job performance related activity.

(b) “Cash & Cash Equivalents” are cash gifts, prizes or awards, including gift certificates and gift cards, which are always considered as taxable compensation to an employee or non-employee, regardless of the dollar amount beginning with the first dollar.

(c) “De Minimis” for purposes of this policy means an award, gift, or prize that is small enough that the accounting for such would be administratively impractical.

(d) “Games of Chance” means poker, craps, roulette, or other game in which a player gives anything of value in the hope of gain, the outcome of which is determined largely by chance, but does not include bingo.

(e) “Gifts” are items given to express appreciation, goodwill or gratitude or could also be related to a holiday season but are not related to job performance.

(f) "Life Event" includes certain events in an individual’s life that are personal in nature and not work related. Examples of life events warranting gifts could include, but are not limited to, the extension of get-well wishes, the birth or adoption of a child, or the death of an immediate family member (as defined by Human Resources’ Benefits Handbook on Bereavement Leave).

(g) "Non-Cash Items"include, but are not limited to spirit wear (clothing, artwork, frames, anything has a tangible value), meals without a business purpose, and food items.. Gift certificates (cards) are treated the same as cash for tax purposes.

(h) "Prizes" are items received as a result of a game of chance, drawing or contests of skill, either with or without the purchase of a chance or ticket and not related to job performance.

(i) "Raffle" means a chance for a prize by one or more people who have purchased a chance to win usually in the form of a ticket.

Policy

The University of Dayton has many centralized rewards and recognition programs for faculty, staff and students and strongly encourages departments or units to utilize these University wide programs. Any additional employment-related or job performance awards should be approved by the Office of Human Resources, specifically the Compensation Manager.

When University funds are being used, the University will comply with IRS regulations and other applicable laws, and expects all employees to assist in this commitment by adhering to University policies and practices as well as federal, state and local laws concerning gifts and awards. Disregard for IRS or other legal requirements in the performance of one’s duties for the University may be subject to disciplinary action by the University.

CASH

All cash and cash equivalent awards (e.g. gift cards), gifts or prizes, represent taxable income to the individual, beginning with the first dollar. Cash and cash equivalents are never considered de minimis regardless of the dollar amount.

NON-CASH

All non-cash awards, gifts or prizes valued at $100 or less may be considered de minimis. De minimis awards, gifts and prizes may only be provided on an occasional basis. Anything greater than $100 represents taxable compensation to the individual and is subject to the appropriate federal, state and employment tax withholdings, as well as included on an individual’s year-end tax document.

LIFE EVENTS

A life event acknowledgement may include a non-cash item or a financial donation to a charitable organization using University funds in accordance with University guidelines. Such life event acknowledgements, when de minimis, do not represent taxable income to the individual. Any financial donation must follow the Guidelines for Charitable Giving Using UD Funds, which include but are not limited by certain approvals and reporting requirements.

PARTICIPANTS IN UNIVERSITY OF DAYTON RESEARCH STUDIES

The University IRB (Institutional Review Board) approves and governs research studies involving human subjects. Any participant in a research study should follow the applicable IRB guidelines. IRS regulations allow employees participating in research studies to be compensated outside the Payroll system as long as the nature of the activity performed by the employee is separate and distinct from the responsibilities associated with his/her position at the University.

FOREIGN RECIPIENTS

Any payment to a foreign individual should be made in compliance with the University’s Non-Resident Payment Policy.

RAFFLES

Any raffles or games of chance require pre-approval by both the Office of Legal Affairs and the Tax Manager, to ensure that such raffles or games of chance comply with Ohio law, IRS guidelines regarding withholding of taxes for prizes, and any other applicable requirements.

See the University of Dayton Awards, Gifts and Prizes Procedures (Appendix A) for processing procedures.

Reference Documents

- IRS Guidance: http://www.irs.gov/Government-Entities/Federal,-State-&-Local-Governments/De-Minimis-Fringe-Benefits

- University of Dayton Awards, Gifts and Prizes Procedures (Appendix A)

- University of Dayton Awards, Gifts, and Prizes Guide (Appendix B)

- University of Dayton Purchasing Card Policy & Procedures

- University of Dayton Distribution of Sale and Materials and Solicitation of or by an Employee Policy

- Ohio Revised Code, Chapter 2915: Gambling

- Foreign Corrupt Practices Act of 1977 15 U.S.C section 78

- University of Dayton Non-Resident Alien Payment Policy

- IRS Guidance: Publication 3079, Tax-Exempt Organizations and Gaming (http://www.irs.gov/pub/irs-pdf/p3079.pdf)

- Guidelines for Charitable Giving Using UD Funds

- Guidance for Incentive Payments to Research Participants

Appendix A

University of Dayton Awards, Gifts and Prizes Procedures

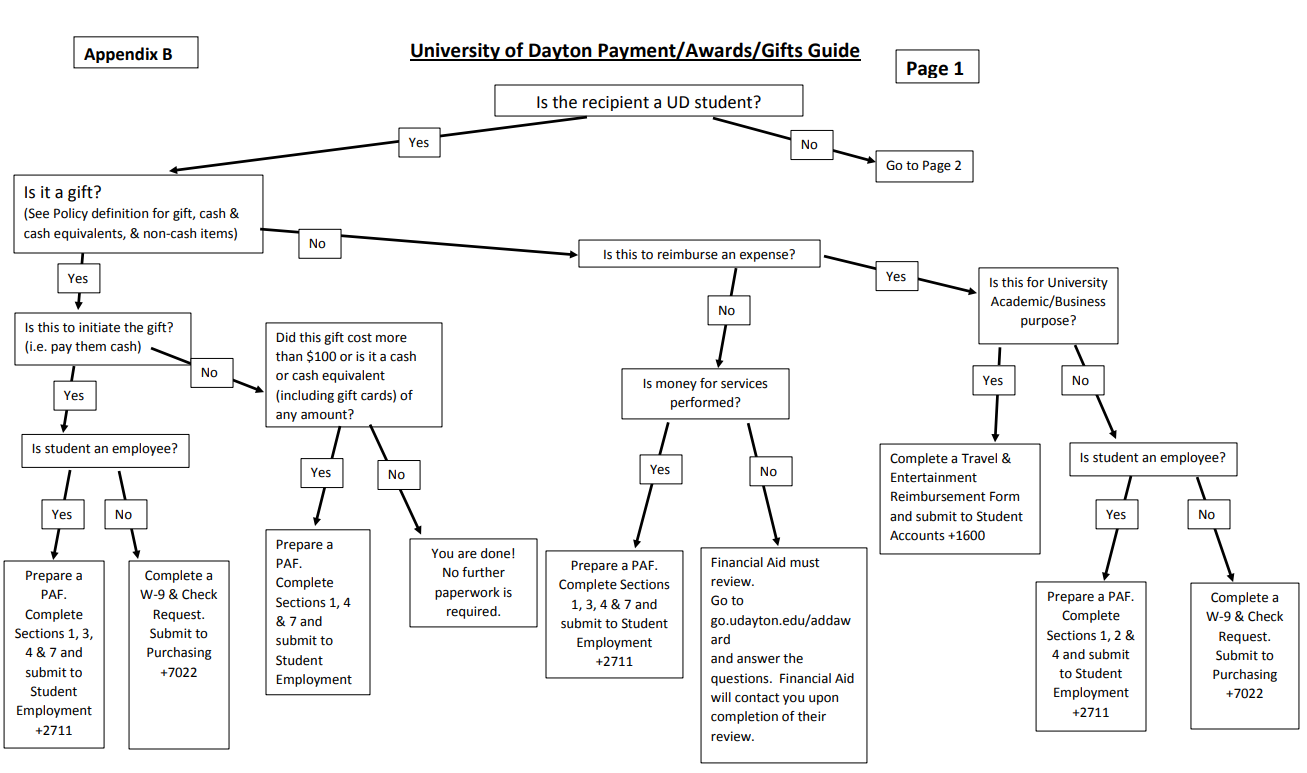

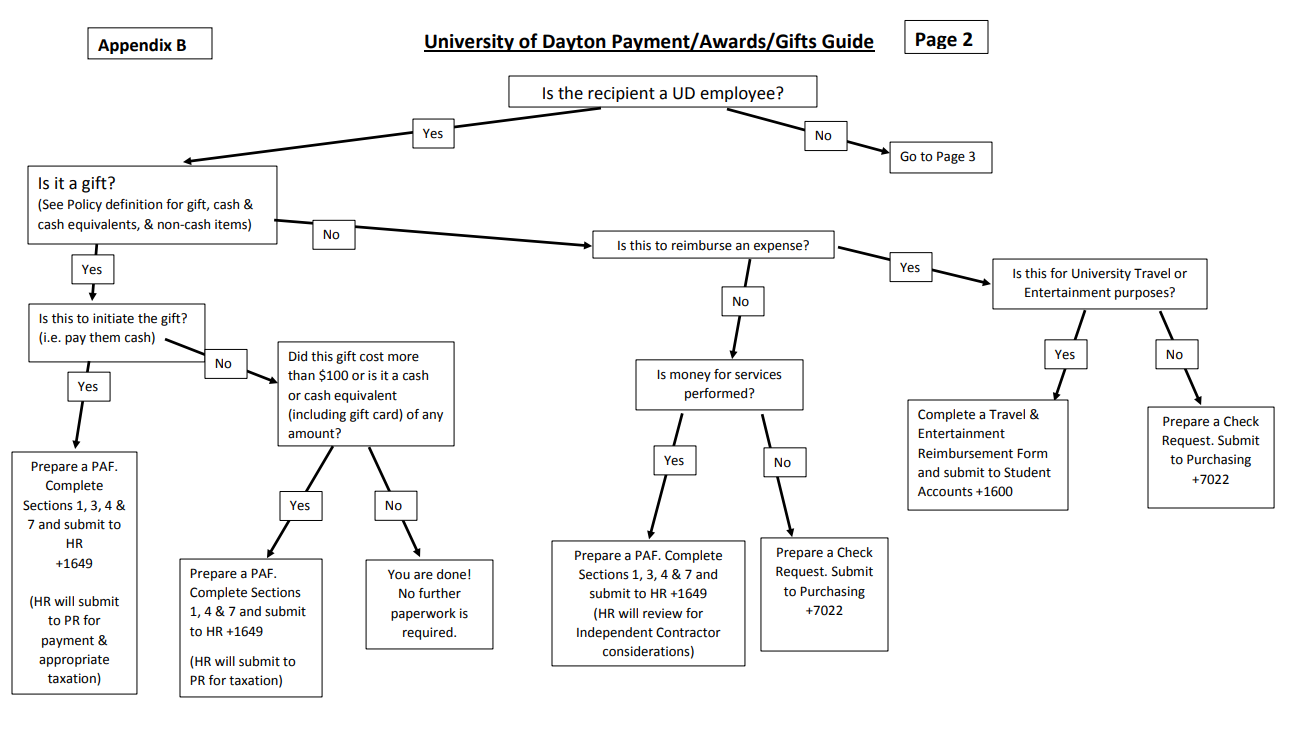

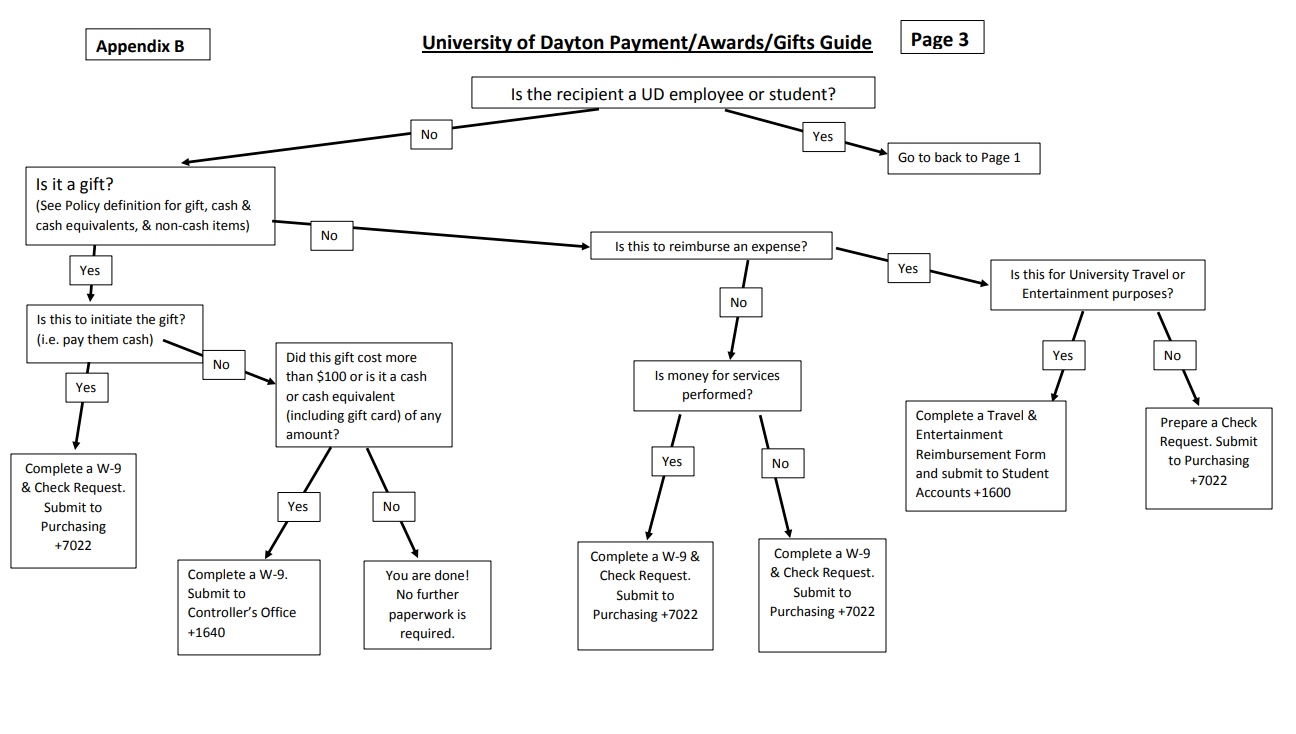

Use the University of Dayton Payment/Awards/Gifts Guide (Appendix B) to determine what forms are required to be completed.

Other Items of Note

- All forms must be submitted within 30 days of the date the individual receives the award, gift or prize.

- Individuals may certainly purchase gifts, awards or prizes using their own money and not seek reimbursement from the University. These self-funded items, even when a collection is taken from several individuals (ie a pass the hat collection within a department) will result in no tax consequences to the recipient. However, personal contributions cannot be combined with University funds nor used to offset the value of a non cash item to qualify as de minimis.

- All personal contributions must be paid directly to the vendor. If any reimbursement from the University is sought, the entire amount of the gift will be used to determine if it qualifies as de minimis.

- Explanations on reimbursement paperwork should clearly name the employee /recipient and the purpose of the request. A receipt or invoice must be included to substantiate the value of the item.

*Students who meet IRS criteria, but are not employees, will receive the appropriate tax document.

Check requests will be held until the above information has been submitted to Payroll, Controller or Human Resources, as applicable.

If you have any questions regarding these procedures, please contact:

- Controller’s Office at 229-2941

- Tax Manager at 229-3600

- Human Resources at 229-1440

- Internal Audit at 229-3870

**Failure to provide the required taxing information to the Controller’s office could result in purchase initiator being held personally liable for tax purposes**

Appendix B

Download a PDF version of the University of Dayton Payment/Awards/Gifts Guide (.pdf)>> University of Dayton Payment/Awards/Gifts Guide